With the constant threat of COVID-19, everyone is at risk every time they step outside their home to do anything. That includes physical transactions AKA handing people money, as well as shopping and banking at our usual, pre-plague locations.

Online shopping via Lazada, Shopee, and Zalora has replaced our regular mall runs, and have made a lot of us appreciate the wonders of cashless transactions. Banks and eWallet platforms like PayMaya have strengthened their apps for the added strain of literally thousands of added transactions per day, and non-traditional banks have surged in popularity.

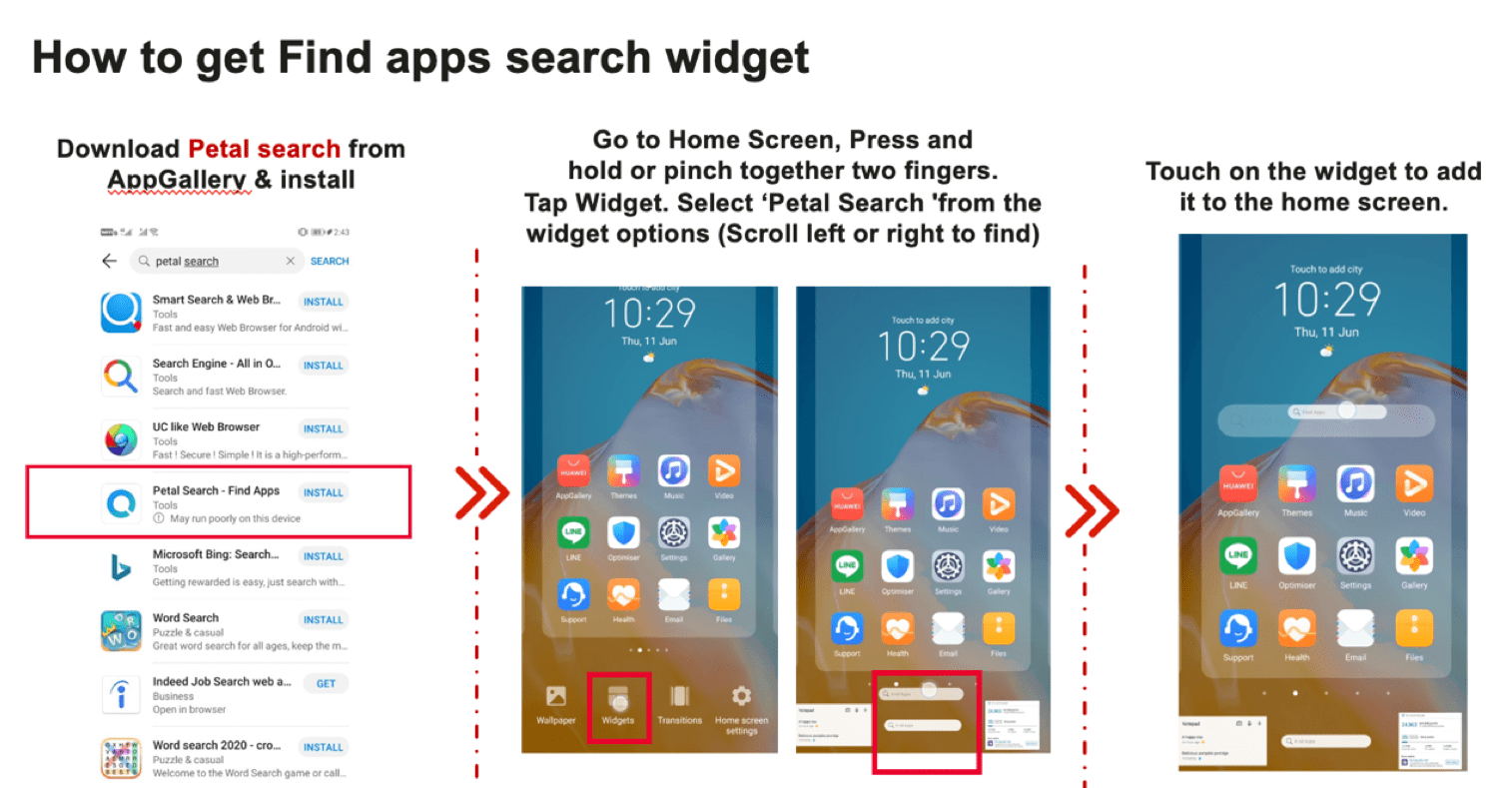

While Huawei’s App Gallery has most of the apps we mentioned above, those not present can be downloaded through Petal Search Widget. By downloading Petal Search Widget on App Gallery and adding its handy widget on your home screen, you can search through over a million apps and install them on your phone. To date, Petal Search Widget lets you search through 90% of popular Android apps including Facebook and Instagram.

If you’re a Huawei smartphone owner and are still on the fence about digital banking, you shouldn’t be. Here are 6 reasons why you should fully embrace the switch to digital banking:

It’s an easy way to receive money

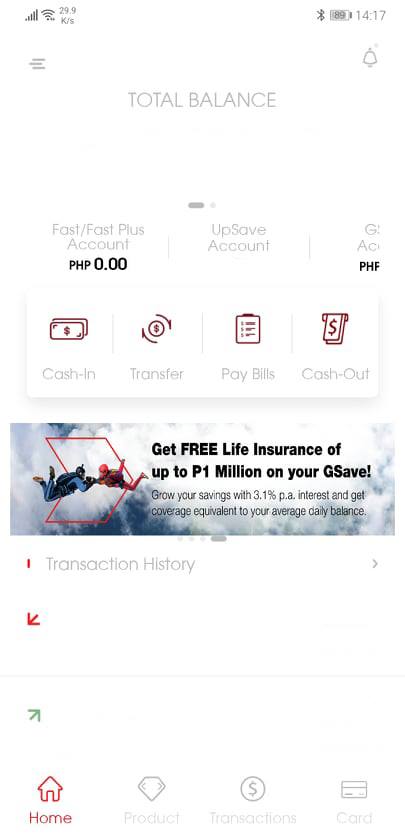

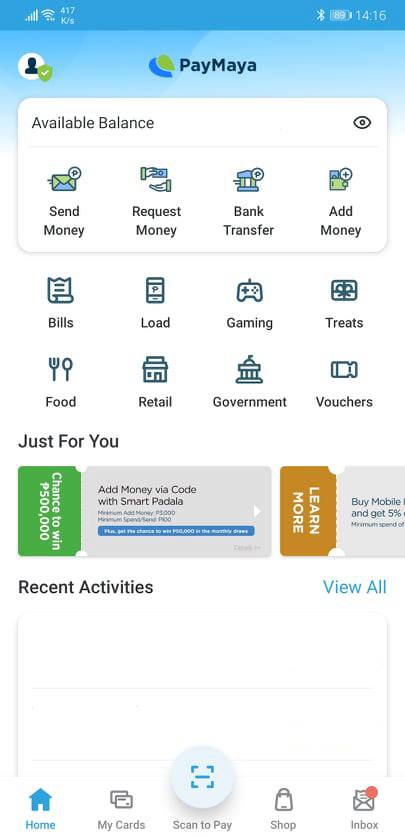

With PayMaya and GCash as one of the most-used eWallet platforms out there, receiving money from friends and loved ones is very easy: all you need is a registered phone number associated with that eWallet, and you can send and receive money wherever you are, whenever you want.

Getting a bank account is actually easy

While mainstream banks like BPI and BDO are making bank transactions convenient though their apps, those with digital bank accounts—CIMB and UnionBank to name a few—makes opening a new bank account ridiculously easy, without having to go to a physical branch. All you need is a valid ID, your verified information, and good cameras for taking a photo of yourself and your IDs for seamless know your customer (KYC) verification. Cameras on Huawei’s phones work incredibly well for this (especially with the nova 7 5G), since its AI has a dedicated mode for shooting government documents like passports and IDs.

CIMB Bank is Best New Digital Bank in the Philippines for 2020

You can do transactions with different eWallet apps seamlessly

Thanks to platforms like InstaPay and PesoNet, you can easily transfer funds from different online banking apps and eWallets. Need to pay something using PayMaya because you want that Balikbayad promo points? No problem – you can add money to your account by transferring money from your preferred online banking account with InstaPay.

It is perfectly secure

Aside from offering 2-factor authentication, these eWallet apps utilize your phone’s biometric authentication methods to ensure that no one would access your accounts without proper authorization. And in case of Huawei phones, their Find my Phone feature will let you track the location of your phone and disable it remotely when needed.

You can do a lot with eWallet apps

Aside from letting you seamlessly send money to your friends and loved ones, eWallet apps lets you pay your essential bills, buy you load, and pay for your online shopping expenses—without the need for a credit or debit card. Aside from acting as debit cards, eWallet apps support QR payments, letting you do contact-free transactions—all you need is a QR code and your phone’s camera.

Aside from convenient payments, apps like CIMB and UnionBank have a savings feature that lets you earn interest from the money you deposit—without any minimum amount. Apps like PesoLoan lets you apply for loans using your phone. Like with verifying your account of opening a digital bank account, loan applications make use of seamless and secure KYC processes to ensure that you get the loans you applied in the fastest time possible.

They’re available at App Gallery!

A big chunk of these popular eWallet apps can be downloaded through Huawei’s App Gallery, which means you’re pretty much covered no matter what bank or app you use. And if by some chance that the apps aren’t available in AppGallery, you can use Huawei’s Petal Search Widget to find said apps in alternate download locations as well.