If you are confused about ATM fees for 2021 in the Philippines, we’ve compiled a quick and dirty list for you to chew on. If you haven’t heard, ATM fees are expected to increase following the ABFC charging scheme that will be implemented across a majority of Philippine banks, which means an increase in ATM fees is in the works. Take note that the fee increase in Philippine ATMs only applies to bank clients who use an ATM that is not owned by his or her bank. These fees shouldn’t affect you if you withdraw directly from the bank that issued your ATM card. It’s almost the same principle as withdrawing cash from an ATM with a foreign ATM card.

For the past seven or more years, existing ATM withdrawal fees range from P10 and P15 per transaction, with this new scheme in place ATM withdrawal fees are expected to range from Php 10 to Php 18. We’ll start seeing this take effect by Early April.

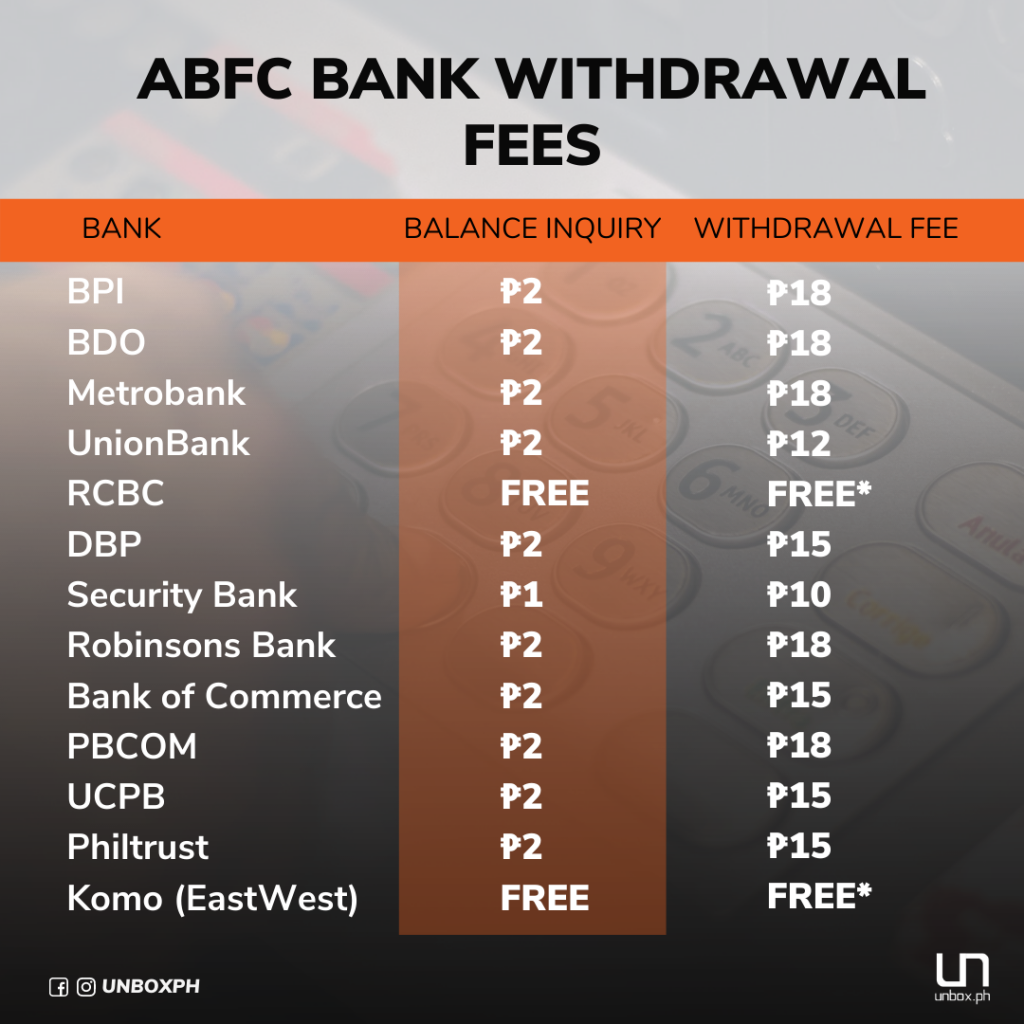

New ATM fees For 2021:

Balance Inquiry Rates

BPI: Php 2

BDO: Php 2

Chinabank: Charged by the bank that owns the ATM terminal

Metrobank: 2

UnionBank: Php 2

RCBC: Free

Development Bank of the Philippines: Php 2

Security Bank: Php 1

Robinsons Bank: Php 2

Bank of Commerce: Php 2

PBCOM: Php 2

PNB: Php 2

UCPB: Php 2

Philtrust: Php 15

Komo (EastWest): Free

Cash withdrawal Rates

BPI: Php 18

BDO: Php 18

Chinabank: Charged by the bank that owns the ATM terminal

Metrobank: Php 18

UnionBank: Php 12

RCBC: Follows the fees of the bank that owns the ATM terminal

Development Bank of the Philippines: Php 15

Security Bank: Php 10

Robinsons Bank: Php 18

Bank of Commerce: Php 18

PBCOM: Php 18

PNB: Php 15

UCPB: Php 15

Philtrust: Php 15

Komo (EastWest): 4 free withdrawals per month Until further notice

PayMaya: Php 15 from most ATMs, and Php 5 from LANDBANK ATMs

The new ATM fees for 2021 in the Philippines also apply for foreign cards, though they do differ. BDO’s updated ABFC fee is USD 3.50 for Mastercard and Visa Plus while Security bank charges Cirrus / Maestro cardholders Php 60 per inquiry and Php 300 for withdrawals. Banks that claim that their fees are free usually follow the fee set by the ATM owner so it’s important to be aware of the existing fees set by other banks. Digital bank owners are most likely to be affected by the ABFC fees since they don’t have a physical bank they can withdraw from.