There’s more to the cashless life

There’s more to the cashless life

There are many reasons why you should get an e-wallet: aside from the convenience of cashless transactions, e-wallets offer a variety of features that makes managing your money a breeze.

GCash, one of the leading e-wallets in the Philippines, offers value-added services like seamless real-time bank transfers. Beyond that, GCash offers more features that any user–both young and old–will enjoy.

We used GCash for a week, and here are the other things we loved about it:

Scan-to-pay is one of the best payment methods out there

Scan-to-pay is one of the best payment methods out there

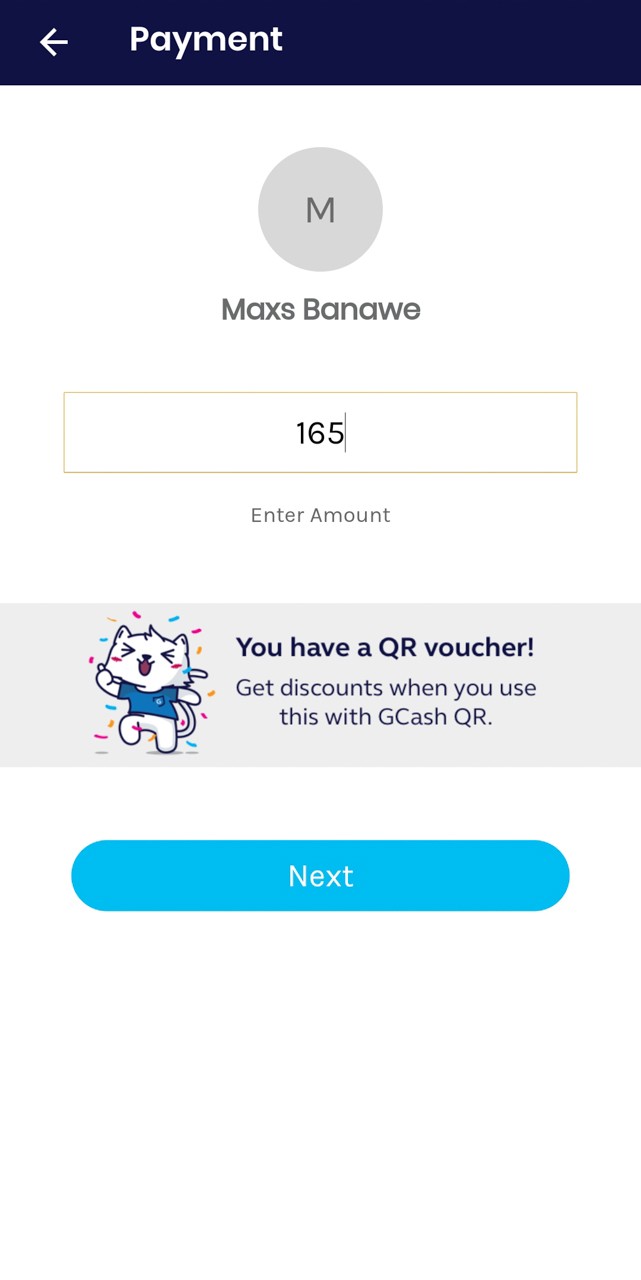

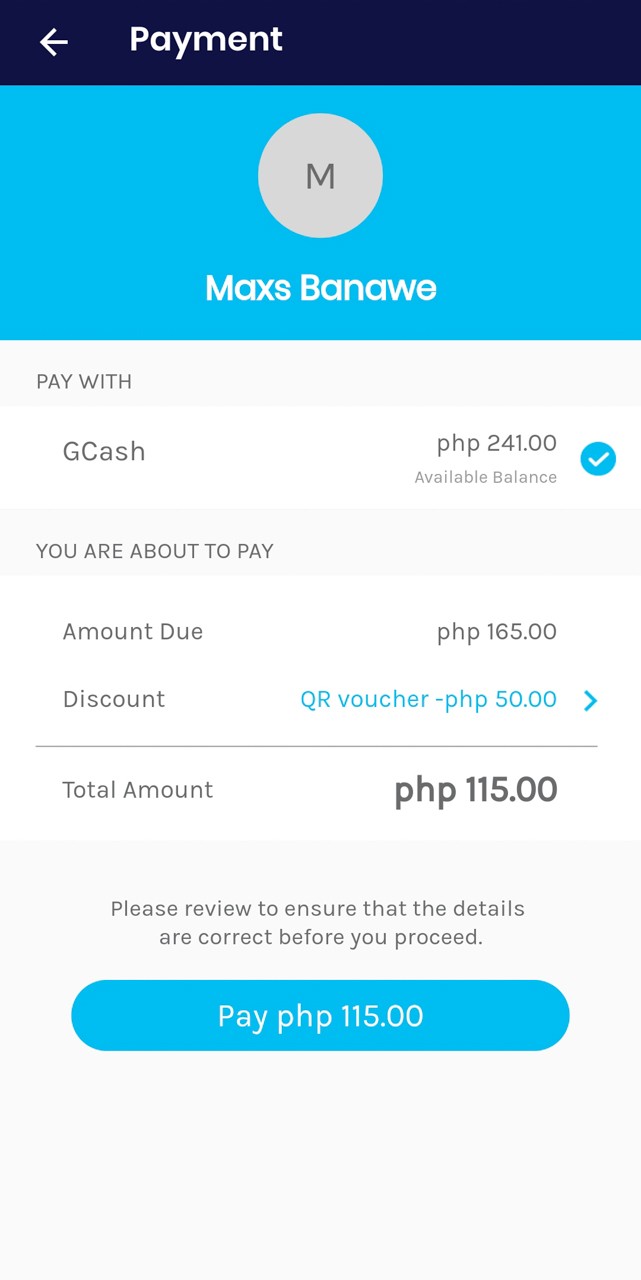

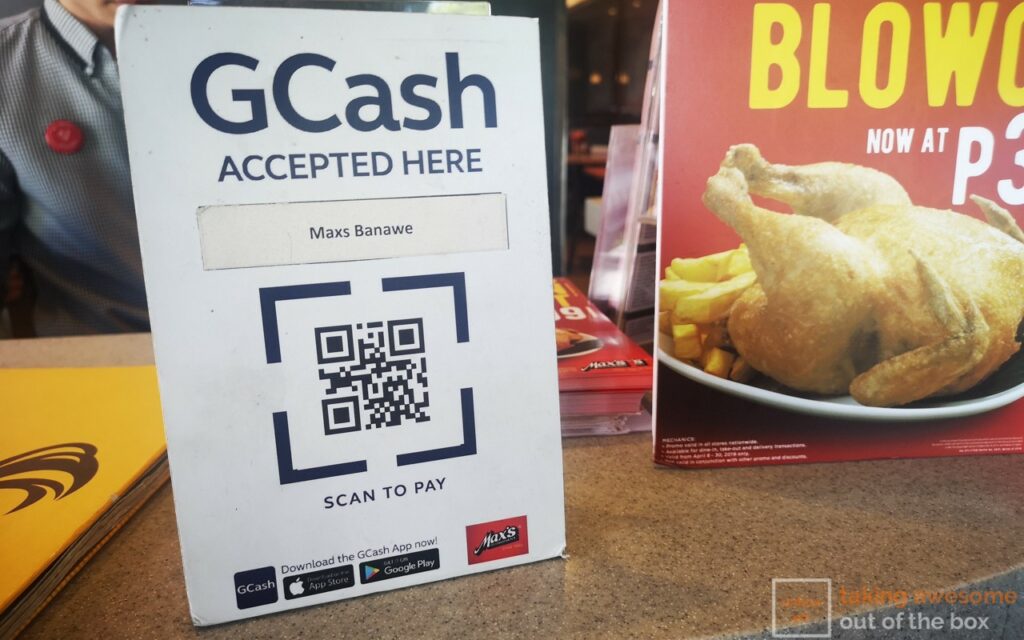

When it comes to cashless payments, scan-to-pay is the most efficient and foolproof way to pay for stuff. Instead of fumbling through numbers, all you have to do is to scan the QR code and type in what you owe. Once done, you get an acknowledgment receipt, which you present to the counter to ensure that the transaction is valid.

GCash QR has already rolled out to several merchants, including chain stores like McDonald’s, Mercury Drug, 7-11, Max’s and many more.

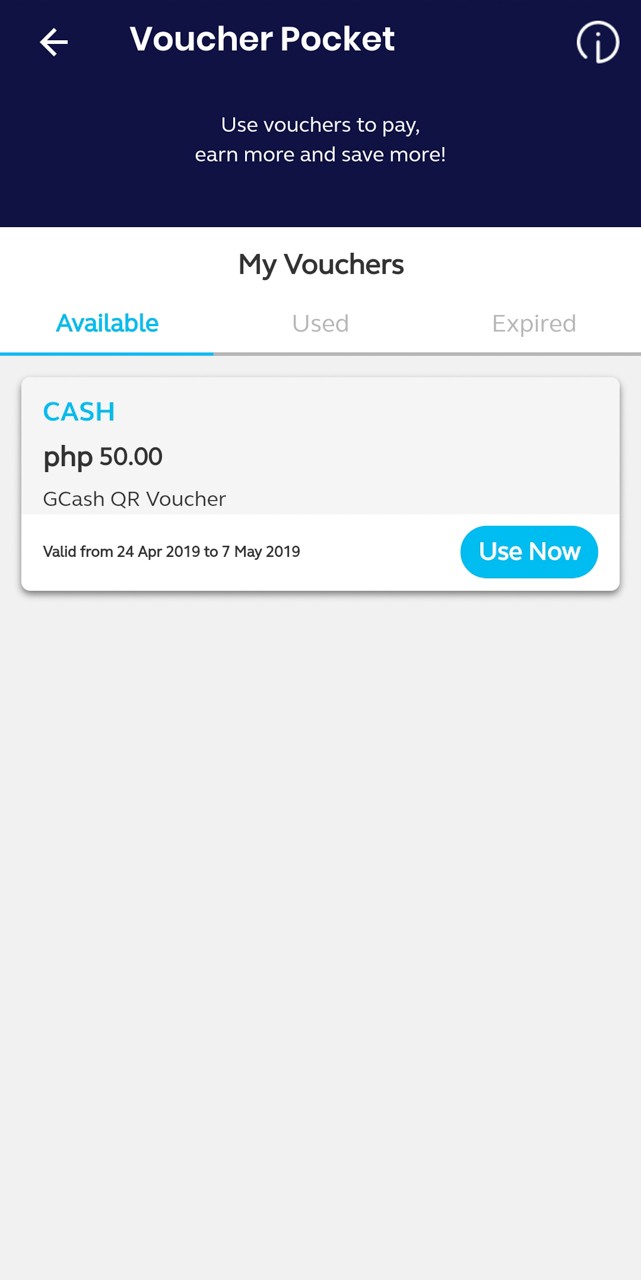

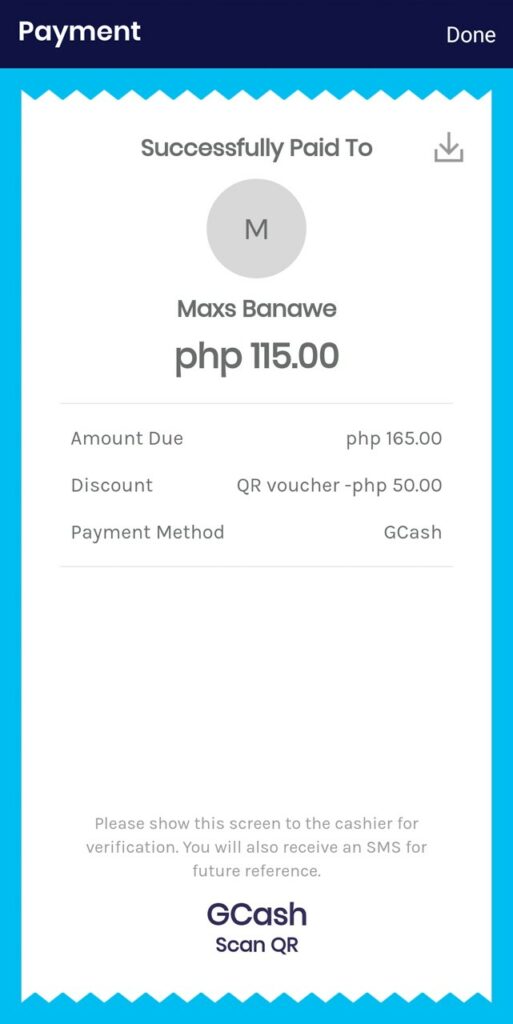

QR discount vouchers are a lifesaver

There are also a bunch of discount vouchers that you can get with GCash. In my case, a subscription to Globe’s GoSurf 299 got me a Php 50 QR voucher for my next GCash purchase. I was able to use the voucher to save Php 50 for a box of Max’s delicious Caramel Bars. Instead of paying Php 165, I ended up paying Php 115 via GCash QR. Ain’t that sweet?

Aside from subscribing to certain load promos, there are a bunch of ways to earn QR vouchers—you just need to monitor GCash’s social media channels for any of their promos.

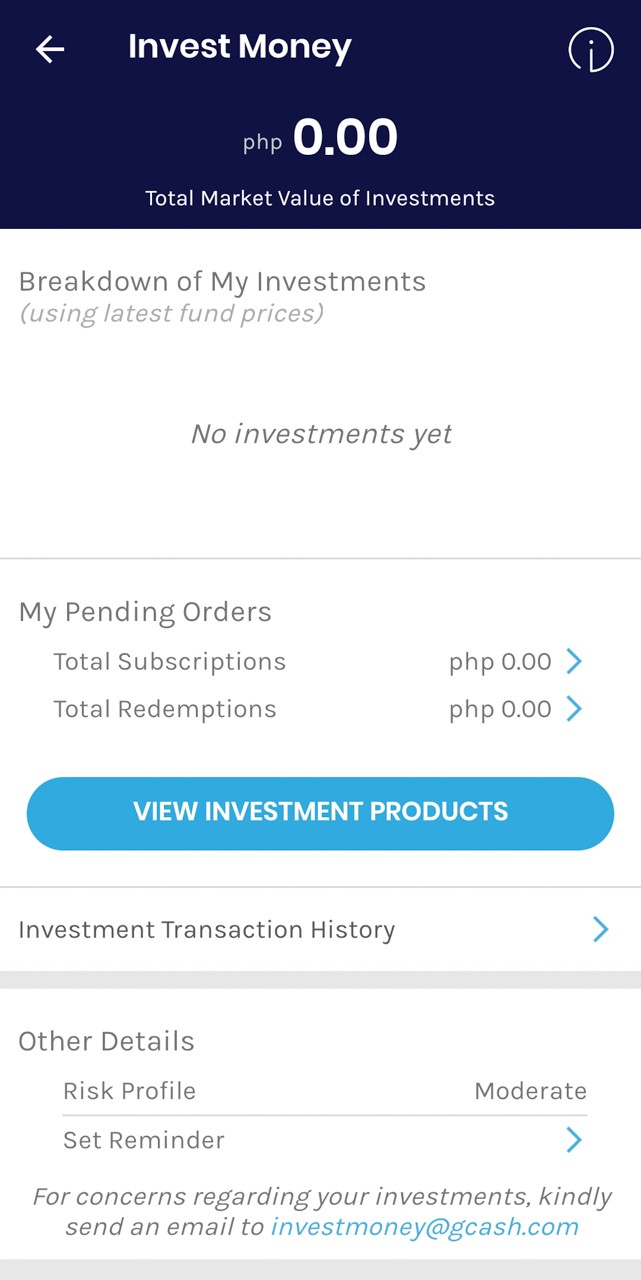

You can invest AND earn money

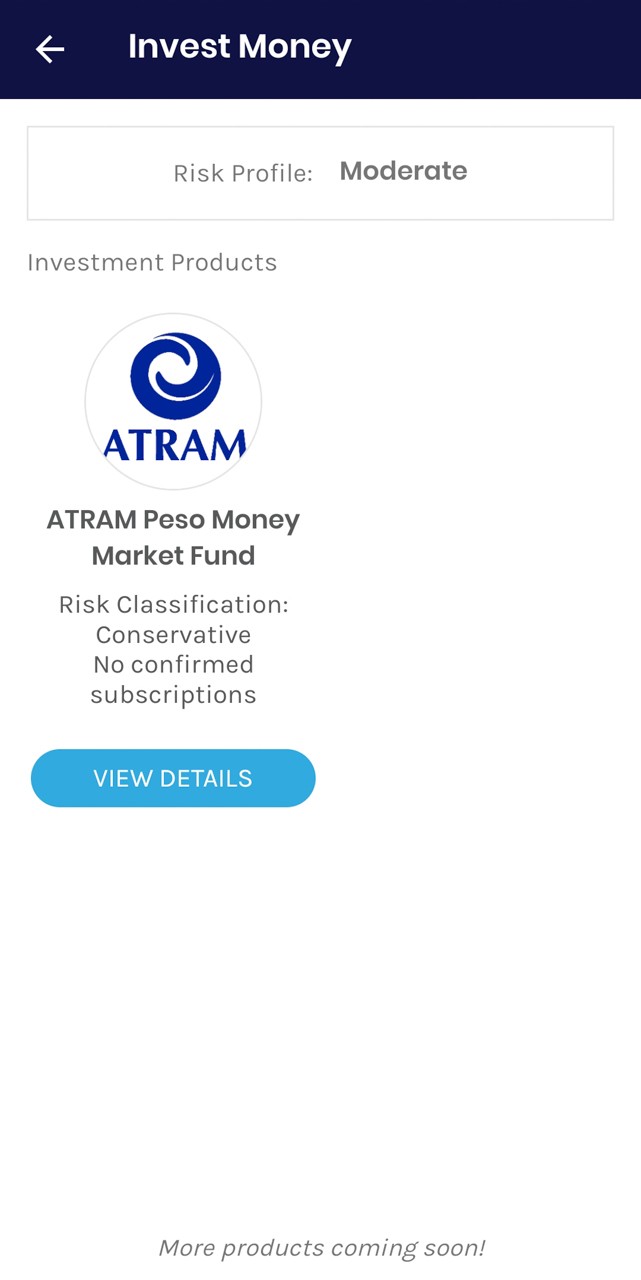

While other e-wallets offer features like being able to pay your bills, buy phone load, or purchase game credits, GCash takes things a step further by offering an invest feature. Currently, GCash offers ATRAM’s Peso Money Market Fund—a conservative Unit Investment Trust Fund (UITF) that lets you achieve higher returns compared to typical bank deposits.

If you’re the kind who wants to learn about investing without shelling out a lot of money, you’ll love this GCash feature. You just need to verify your email, answer a few questions (for your investment profile), and invest at least Php 50 to have your own UITF via GCash. You will receive a confirmation of your investment within 1 to 2 business days after subscribing—and start seeing your money earn.

I personally invested Php 126 to ATRAM’s Peso Money Market Fund, and the whole process took only minutes before I received a confirmation of my UITF subscription.

With all these features, saving AND earning money is easy and convenient using GCash.