Looking for an investment opportunity that is accessible and convenient? Bonds.ph, PayMaya, and the PH Bureau of Treasury team up for an accessible way for people to invest in its upcoming Progreso Retail Treasury Bonds. With an interest rate of 2.625% per annum for 5 years, the Bureau of Treasury’s latest Retail Treasury Bonds in the Philippines is the first to be offered through the use of Fintech apps like PayMaya and Bonds.Ph.

“Opening up various online channels that allows Filipinos to invest will ensure a wider participation from individual investors, particularly for this offering,” National Treasurer Rosalia de Leon said.

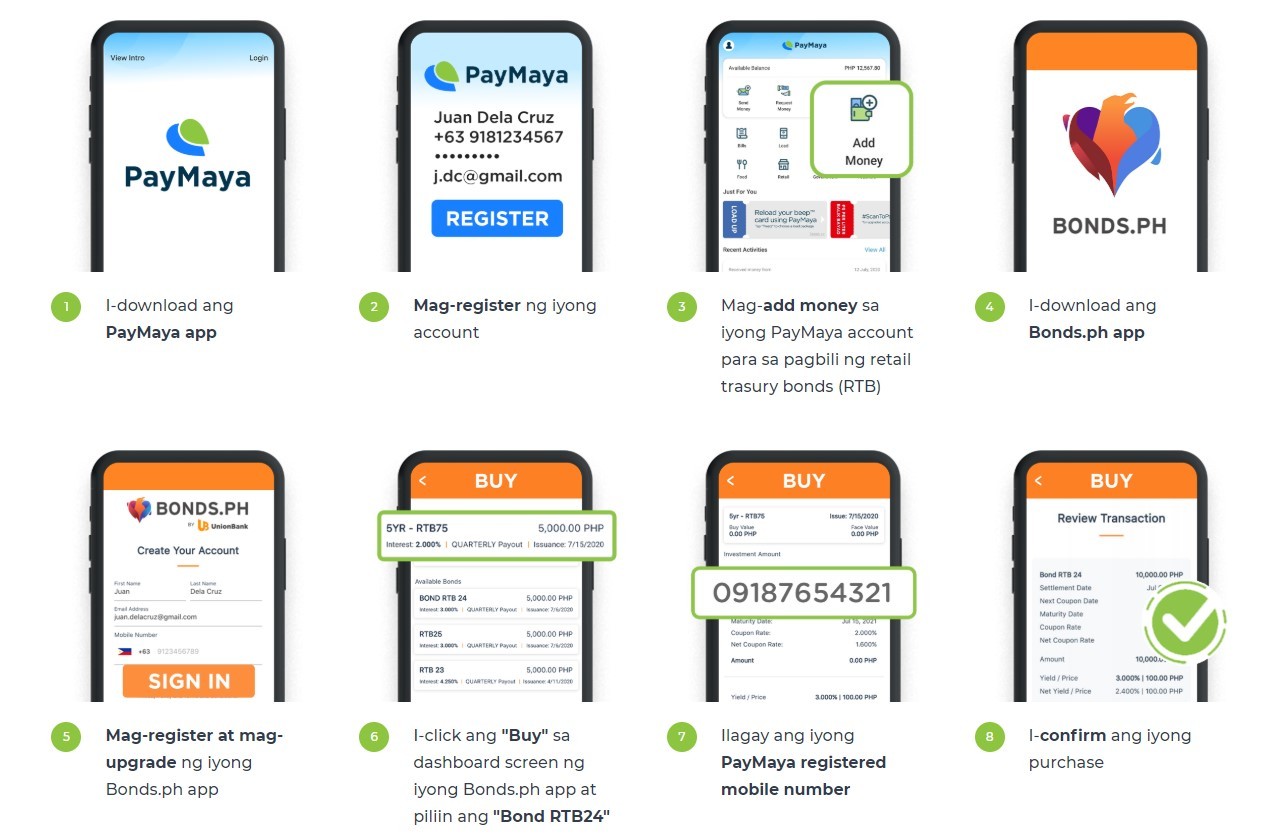

For a starting investment of Php 5,000 (which can be increased in multiples of Php 5,000, maximum of Php 500,000), investors are expected to earn Php 525 in five years, which is far better than any savings account right now. Placing an investment is easy—make sure to have both PayMaya and Bonds.ph apps, and follow the instructions below:

As a low-risk online investment, Retail Treasury Bonds in the Philippines are a good opportunity for those who are still learning the ropes of investing. Aside from having quarterly payments, RTBs are classified as liquid assets and can be bought or sold through selling agents (subject to minimum requirements and market rates).

The Progreso Retail Treasury Bonds are currently being offered until August 7.

You Can Now Deposit Money To Your UnionBank Account Via 7-Eleven