It is always better to be safe than sorry

Fraudsters are getting smarter these days. Despite our best efforts, newer, more sophisticated phishing techniques can victimize even the most vigilant if we’re not careful enough. While financial institutions like BPI use state-of-the-art technology to ensure the security of client data, security is still a shared responsibility.

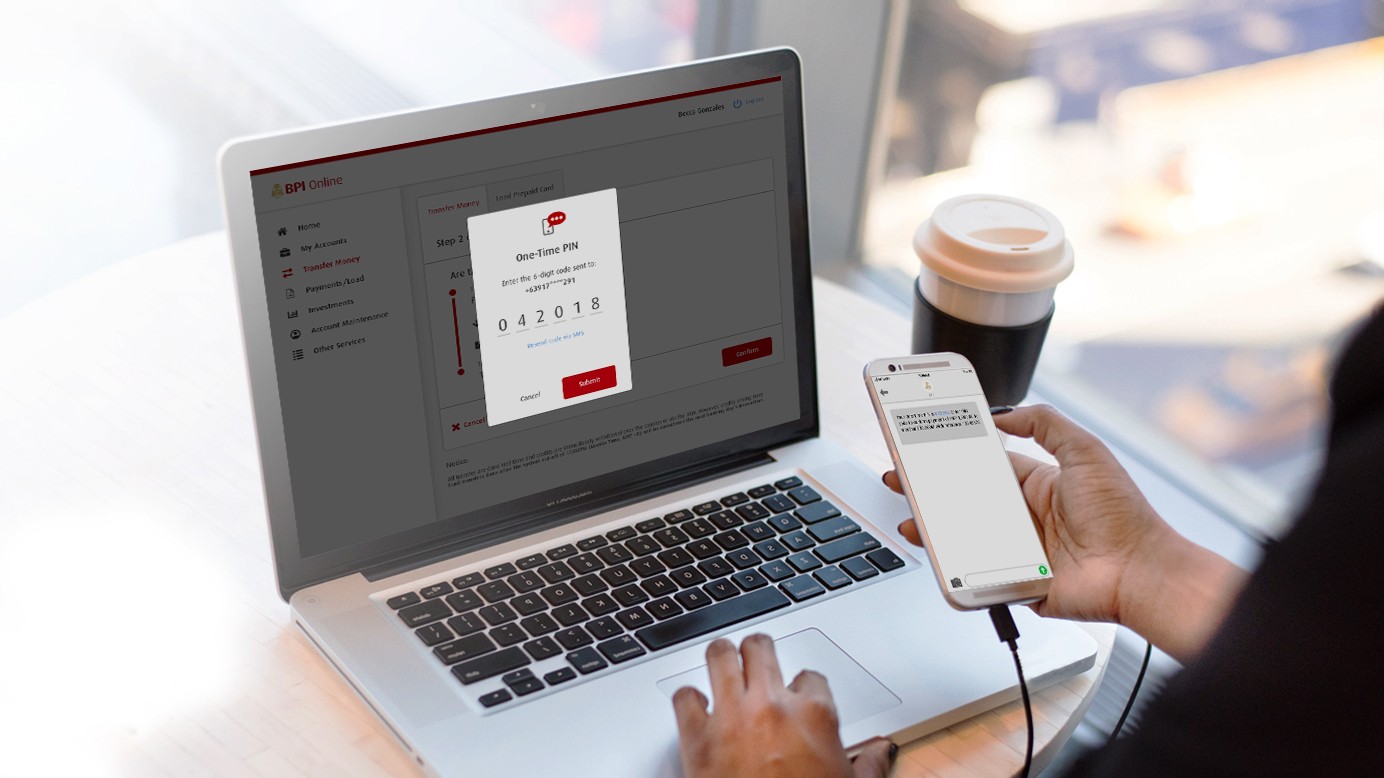

For example, one of BPI’s security features is the One-Time PIN (OTP), a unique 6-digit password sent to your registered mobile number to ensure that a financial transaction done via mobile or online banking is really authorized by you.

It gives you an extra layer of security as BPI will only send the OTP to the mobile number linked to your account. As long as you have your phone with you and you keep your OTP to yourself, fraudsters can’t complete any financial transaction using your account. What’s even better is that your OTP expires in 5 minutes, so if it’s not used within that time frame, it becomes invalid, requiring a new one to complete a transaction.

Just like regular PINs, you must keep your OTP private. Otherwise, you give fraudsters the opportunity to perform unauthorized transactions using your account. Some scammers pretend they are bank employees and call clients to ask your OTPs. Don’t fall for it!

As for BPI, their model is to never ask for your OTP and other account information through embedded forms, email links, calls, SMS or social media. If you receive a call or email asking you to provide any confidential information, do not engage. Immediately change your online banking password and report the incident to 89-100.

How Technology Is Transforming The Way You Do Business With Your Bank